Riding Hype Cycles

How they start, why they work, and how to use them to fundraise.

One of the bigger things in fundraising is the concept of hype - what it is, how to think about it, and how to use it to get a fundraise done. In this essay, I’m going to dig into the dynamics of hype using AI companies - clearly the current leader in startup hype - as the lens. I think hype is misunderstood. It’s often treated as something bad or fake, but it's not - it's a tool and it's one that founders should use.

First, let’s work through an understanding of what hype is and how it functions in the system. Our goal is to figure out a way to use hype to make a fundraise easier. It would be nice if that also guaranteed success for your startup, but we can’t do that. There’s no level of excitement for you, your business, your story, or your clever tweets that can change the ultimate trajectory of what you’re building. But to the extent that you need money to realize your ambitions, hype can help get it.

Now, hype is currently focused on AI. Three years ago it was focused on crypto. The speed at which hype cycles move and what they can and cannot do for a business is important to keep in mind. If you want a good example of a place in which a hype cycle can supercharge a sector of the market but not guarantee success, look at how many crypto companies were able to raise massive amounts of money using hype and then had nothing afterwards. I know a number of companies that raised hundreds of millions of dollars and are sitting here years later with a massive pref stack, a crazy high price, and kind of nothing to show for it. That’s a good reminder that - as with any tool - just because you have the benefit of hype doesn't mean you should use it to its fullest power.

The way hype cycles work is kind of fun. Basically what happens - and we'll use this the AI example - is that first you need sort of a big bang moment. That’s a catalyst where something happens that creates hype. For anyone building an AI company, the moment for that was the release of ChatGPT. Now, there were AI companies before that, there were interesting things happening before that, but that's the moment where everyone all over the world all of a sudden said, "Oh holy crap, look at this thing happening. We should pay attention to it."

That release is T0. What happens at T1 is fascinating because it kicks off the cycle. At T1 some startup uses the excitement generated by the catalyst event to raise money. The fundraise needs to be splashy, and, again, we can thank OpenAI. They had raised a lot of money before launching GPT and as soon as it exploded they set about raising a hell of a lot more. We can surmise what happened during their fundraise - which is emblematic of these types of things: OpenAI went out and talked to a number of VCs - or those VCs came to OpenAI and asked for the opportunity to invest. At that point, one of two things happened: the VCs wanted to do the deal and couldn't get in, or they didn't get the opportunity to see it and wished they had.. Or, maybe a third option - they saw the OpenAI pitch, got excited about the opportunity, and then decided that they wanted to see a different answer to a similar question. So maybe they funded Anthropic?

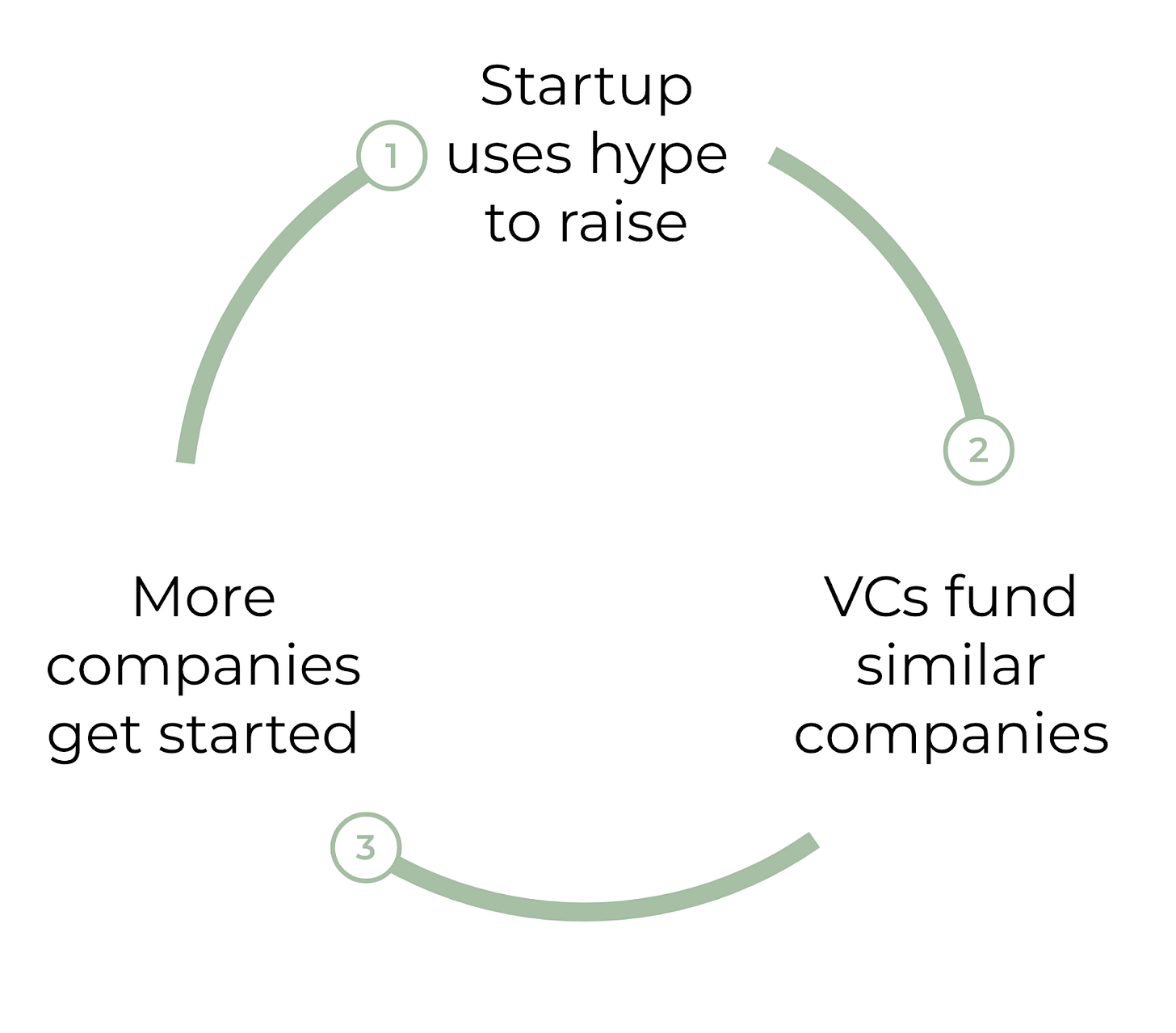

Those VCs then go and find another company and fund something similar to the first company that got funded off the hype cycle. And then a whole bunch of founders see VCs funding things and they think to themselves, "Oh huh, there's money there. Either we should build specifically like that to capture a similar opportunity or we're going to change our narrative structure—the story that we tell—to capture some of that hype.” So those founders start companies that then get funded, and the cycle just goes.

That’s a flywheel, a hype cycle. As more companies get started and they attract more funding, more VCs look at it. And then you have funds that say - at least in this cycle - "We're crypto only. No, no, no, no, no, we're AI only. We are an AI fund. We're saying it out loud and telling our LPs and that's what we do." Once they tell their LPs, they have to fund AI companies. The cycle gets bigger.

Let’s take a step back and talk about how it actually works. To do this, we need to understand investor psychology. At core, a VCs job is to make a whole lot of money. The way you do that is by investing in the largest possible companies at the lowest possible price. The low price bit is easier for earlier stage companies.

Now, the larger the potential outcome, the more excited the investor will be. For instance, the common investor math used to say that a company that exits at $5B or greater has produced an excellent outcome. That’s a big company. There aren’t many of them. At that exit, investing at a $100 million valuation is fine, investing at $1 billion valuation is not great.

But OpenAI changed these rules. It’s already worth somewhere north of $150 billion in the private markets. At that price, investing at $1 billion would still have produced an incredible outcome - assuming there’s a liquidity event. If investors start to believe that there are more OpenAI sized opportunities, they will be willing to invest more at ever higher prices. We’re already seeing this happen with companies like Cursor raising at $2B and then $10B within months.

What might seem crazy here is we still don’t know the terminal value of any of these companies. That’s the thing that matters for returns, but they hype cycle moves a lot faster than the returns cycle.

Fundamentally we’re talking about the challenge of predicting the future. What VCs are investing in, basically, are stories. It's your job as a founder to tell a story about how your company creates and then captures an unbelievably large economic opportunity at some point in the future.

This is something that founders often miss because they tell a story along the lines of, "Oh, the world is going to be different in the future; we fit into it." That’s not it! If all you do is fit into a trend, then you’re not interesting and you don’t win. Think about agentic coding for a second - it isn’t enough to simply deploy an agentic workflow into an IDE and then run around Sand Hill collecting checks. You’ll get lots of pushback - how are you different from the dozen other AI coding companies? What’s your GTM? Who is the target customer and what are margins? How are you going to unseat Cursor and Devin and fight OpenAI and Claude?

You can’t just fit into the future, you have to cause the phase change in the way markets work. You have to knock the world off its axis. That's how you create and actually capture the opportunity. When you tell that story well, you capture the attention of the investors.

VC attention is actually the limited commodity. If you think about the job of a VC and how it is structured, a lot of it is focused on sourcing. Investors have to go and find companies to talk to, evaluate, and invest in. That takes time and focus. The limiting factor isn't actually money. There’s a lot of money. The big firms have near infinite money to fund whatever they want. But no matter how much money they have, they can’t create more time in their days to look at and think about interesting opportunities. You need to figure out how to grab that attention for yourself and then turn that attention into excitement. That's hard because attention can easily flip into pessimism, which is not what you want.

To bring this back to the concept of hype, hype is a market condition and a tool. It's a way to describe the state of the market. People are excited, they are hyped on something. And then it gets used as a specific tool that founders can deploy in telling the story of their companies.

When there's hype in the market, VCs become extra attentive to any company that fits the hype narrative. That's not to say they'll invest, but they have to pay attention to that company/trend because it's what everyone's talking about all over Twitter, blogs, etc. If your story fits the narrative that they’re constantly thinking about, you get their attention. Good.

At that point, hype elevates fomo for investors. The process will run faster, the prices investors are willing to pay will climb, and the amount of free dinners you can collect will rise. That can be overwhelming and I’ve seen quite a few founders lose the plot and start trying to maximize for the value of the current round, whereas the key optimization always needs to be around terminal value. But that’s for another essay.

If you have hype, congrats - use it wisely. If you don’t, you can still build a great company and fundraise, you just have to work harder at it.

__

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.