Series A activity: Week of August 18, 2025

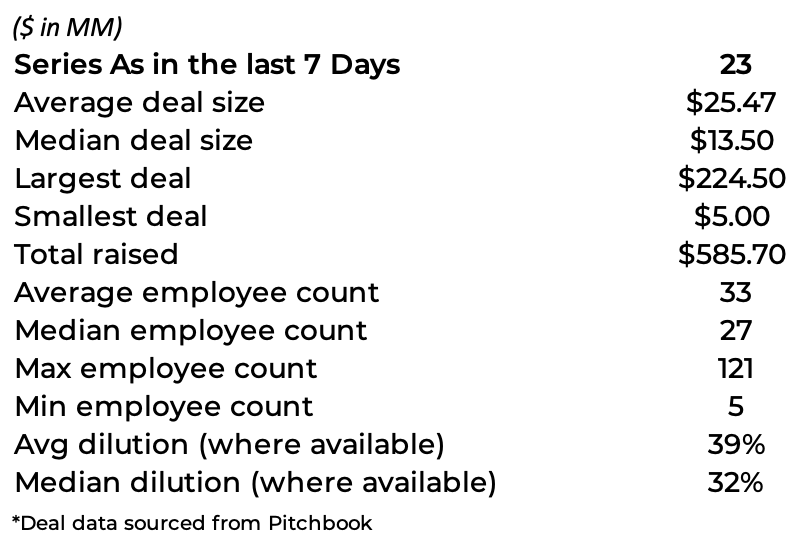

There were 23 Series As in the last week that raised a total of $586 million. The average deal size was $25 million while the median was $14 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

Basic Capital raised $25 million at an unknown valuation from Forerunner Capital and Lux Capital on August 18, 2025. The CEO is Abdul Al-Asaad. Basic Capital is based in New York, NY. Basic Capital is a developer of a retirement savings platform designed to help employers provide 401(k) benefits. Website: www.basiccapital.com

Block Earner raised $5.21 million at a $48.86 million valuation from CMCC Global on August 18, 2025. The CEO is Charlie Karaboga. Block Earner is based in Dawes Point, Australia. Block Earner is a developer of a blockchain-powered fintech platform designed to offer seamless access to blockchain finance. Website: www.blockearner.com.au

Evulpo raised $10.94 million at an unknown valuation from Aribeda, Bruno Pfister, Dario Fazlic, Felix Grisard, Serpentine Ventures, and Yann Sommer on August 18, 2025. The CEO is Christian Marty. Evulpo is based in Zurich, Switzerland. Evulpo is a developer of an online learning platform intended to deliver video-based, engaging, and accessible education. Website: www.evulpo.com

Luna Diabetes raised $23.6 million at a $45.5 million valuation from Vensana Capital on August 18, 2025. The CEO is John Sjolund. Luna Diabetes is based in Wilmington, DE. Luna Diabetes is a manufacturer of an automated insulin delivery system designed for overnight use by insulin pen users. Website: www.lunadiabetes.com

Better Meat raised $31 million at a $45 million valuation from Future Ventures and Resilience Reserve on August 18, 2025. The CEO is Paul Shapiro. Better Meat is based in West Sacramento, CA. Better Meat is a producer of plant-based protein and mycoproteins intended to offer authentic and nutritious meat alternatives. Website: www.bettermeat.co

Apeiron Labs raised $7.75 million at a $38 million valuation on August 19, 2025. The CEO is Ravi Pappu. Apeiron Labs is based in Cambridge, MA. Apeiron Labs is a developer of an ocean monitoring platform designed to improve hurricane forecasting, weather, and long-term climate trends. Website: www.apeironlabs.com

Casca raised $29 million at a $130 million valuation from Canapi Ventures on August 19, 2025. The CEO is Lukas Haffer. Casca is based in San Francisco, CA. Casca is a developer of a loan origination system designed for automating manual banking tasks. Website: www.cascading.ai

Q5D Technologies raised $13.5 million at an unknown valuation from Chrysalix Venture Capital, Lockheed Martin Ventures, and Maven Capital Partners UK on August 19, 2025. The CEO is Stephen Bennington. Q5D Technologies is based in Portishead, United Kingdom. Q5D Technologies is a developer of an advanced manufacturing platform designed to automate the production of wiring harnesses for automotive, aerospace, and industrial applications. Website: www.q5d.com

Yourway Learning raised $9 million at a $14 million valuation from Greybull Stewardship on August 19, 2025. The CEO is Jerry Weissberg. Yourway Learning is based in Miami Lakes, FL. Yourway Learning is an operator of a learning innovation and technology company intended to make learning more personal for students and instruction more efficient, effective, and impactful for teachers. Website: www.yourwaylearning.com

Bluefish raised $20 million at a $73 million valuation from NEA on August 20, 2025. The CEO is Alex Sherman. Bluefish is based in New York, NY. Bluefish is a developer of an AI-powered marketing solution platform designed to help businesses automate and optimize their marketing campaigns. Website: www.bluefishai.com

Digitt raised $10 million at an unknown valuation from Yolo Investments on August 20, 2025. The CEO is David Aceves. Digitt is based in Guadalajara, Mexico. Digitt is a provider of smart and transparent fintech services intended to assist people in paying off credit card debt. Website: www.digitt.com

Garage raised $13.5 million at a $72 million valuation from Infinity Ventures on August 20, 2025. The CEO is Martin Hunt. Garage is based in New York, NY. Garage is an operator of a vehicle and equipment transaction marketplace intended to facilitate the buying and selling of pre-owned firefighting equipment. Website: www.shopgarage.com

Highway raised $224.5 million at an $861.5 million valuation from FTV Capital on August 20, 2025. The CEO is Jordan Graft. Highway is based in Dallas, TX. Highway is a developer of digital transportation technology designed to offer freight matching and carrier engagement services to reduce fraud and supercharge digital bookings. Website: highway.com

Molecular You raised $5 million at an unknown valuation from Voloridge Health on August 20, 2025. The CEO is James Kean. Molecular You is based in Vancouver, Canada. Molecular You is a developer of a comprehensive health assessment platform designed to analyze and interpret an individual's biological data. Website: www.molecularyou.com

Tiny Fish raised $47 million at a $186 million valuation from ICONIQ Capital and U.S. Venture Partners on August 20, 2025. The CEO is Shuhao Zhang. Tiny Fish is based in Cupertino, CA. Tiny Fish is a developer of an artificial intelligence-based software development platform designed to empower machines to communicate and collaborate. Website: www.tinyfish.io

Wisdom raised $28 million at an unknown valuation from Permanent Capital on August 20, 2025. The CEO is Stoyan Kenderov. Wisdom is based in New York, NY. Wisdom is a developer of a dental billing and revenue management platform designed to reduce administrative burden, enhance billing accuracy, and streamline insurance and patient payment processes. Website: www.withwisdom.com

DecentralGPT raised $10 million at an unknown valuation from AGICrypto Capital on August 21, 2025. The CEO is Vitalii Chelpanov. DecentralGPT is based in New York, NY. DecentralGPT is a developer of a decentralized AI large language model designed to support a variety of open-source or closed-source LLM models. Website: www.decentralgpt.org

Irys raised $10 million at an unknown valuation from CoinFund on August 21, 2025. The CEO is Joshua Benaron. Irys is based in London, United Kingdom. Irys is a developer of a decentralized platform designed to ease data storage on Web3 technology. Website: www.irys.xyz

Method AI raised $20 million at an unknown valuation from Cleveland Clinic and JobsOhio Growth Capital on August 21, 2025. The CEO is Douglas Teany. Method AI is based in Boston, MA. Method AI is a developer of an AI surgical navigation platform designed to improve patient outcomes for robotic surgical oncology procedures. Website: www.methodsurgical.ai

Barti raised $12 million at an unknown valuation from Five Elms Capital on August 25, 2025. The CEO is Colton Calandrella. Barti is based in San Francisco, CA. Barti is a developer of a medical records system software designed for storing healthcare records electronically. Website: www.barti.com

Enmovil raised $6 million at an unknown valuation from Sorin Investments on August 25, 2025. The CEO is Ravi Bulusu. Enmovil is based in Hyderabad, India. Enmovil is a developer of a logistics decisions and management platform designed to solve the problem of operational efficiency. Website: www.enmovil.ai

Pintarnya raised $16.7 million at an unknown valuation from Square Peg Capital on August 25, 2025. The CEO is Nelly Nurmalasari. Pintarnya is based in Jakarta, Indonesia. Pintarnya is an operator of a job portal intended to provide employment and financial opportunities for blue-collar workers in Indonesia. Website: www.pintarnya.com

WizCommerce raised $8 million at an unknown valuation from Peak XV Partners on August 25, 2025. The CEO is Divyaanshu Makkar. WizCommerce is based in Delhi, India. WizCommerce is a developer of a sales management platform designed to create custom product catalogs for online businesses. Website: www.wizcommerce.com

Claude’s view

Looking through these deals, three particularly stand out to me:

Luna Diabetes - This company is addressing a critical health challenge with their automated insulin delivery system for overnight use. What's compelling is how they're targeting a specific, underserved segment (insulin pen users) rather than trying to replace entire pump systems. The $23.6M raise at a $45.5M valuation suggests strong investor confidence in their focused approach to improving diabetes management during sleep, which could meaningfully impact millions of people's quality of life.

Q5D Technologies - The manufacturing automation angle here is fascinating, especially their focus on wiring harnesses for automotive and aerospace applications. With the massive shift toward electrification in vehicles, automating the production of complex wiring systems could be incredibly valuable. Having Lockheed Martin Ventures as a lead investor signals serious validation from an industry giant who understands the technical challenges and market opportunity.

Tiny Fish - While the description is somewhat vague about "empowering machines to communicate and collaborate," the investor lineup is impressive (ICONIQ Capital and U.S. Venture Partners) and the $47M raise at a $186M valuation suggests they're onto something significant in the AI infrastructure space. Given the current explosion in AI applications, platforms that enable better machine-to-machine interaction could become critical infrastructure.

Each of these tackles a substantial market opportunity with clear technical differentiation, backed by credible investors who likely did deep diligence on the technology and market potential.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.