Series A activity: Week of July 7, 2025

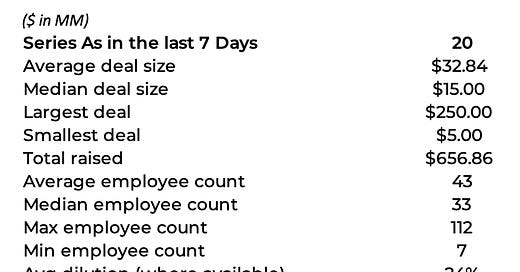

There were 18 Series As in the last week that raised a total of $657 million. The average deal size was $33 million while the median was $15 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

Series A Deals - July 2025

Agora raised $49.5 million at an unknown valuation from Paradigm and Dragonfly Capital on July 7, 2025. The CEO is Nicholas van Eck. Agora is based in Jersey City, NJ. Agora is a developer of a digital token platform intended to offer a fully collateralized, freely tradeable US digital dollar. Website: www.agora.finance

Foxen raised $49.0 million at an unknown valuation from Level Equity and Summit Partners on July 7, 2025. The CEO is James Harkrider. Foxen is based in Columbus, OH. Foxen is a developer of insurance compliance and rent reporting products designed for the multifamily housing industry. Website: www.foxen.com

GetWhy raised $54.5 million at a $92.97 million valuation from PeakSpan Capital and Arbejdernes Landsbank on July 7, 2025. The CEO is Casper Henningsen. GetWhy is based in Copenhagen, Denmark. GetWhy is an operator of a consumer data platform intended to provide consultancy services. Website: getwhy.io

InPrime Finserv raised $6.02 million at a $10.47 million valuation from Pravega Ventures, InfoEdge Ventures, Kettleborough VC, and Z47 on July 7, 2025. The CEO is Rajat Singh. InPrime Finserv is based in Bengaluru, India. InPrime Finserv is an operator of an online financial lending platform intended for middle-class emerging segments. Website: www.inprime.in

Kuru Labs raised $11.6 million at a $13.6 million valuation from Paradigm, 3nes, Alex Watts, Credibly Neutral, Electric Capital, Joe Takayama, Jordan Hagan, Shreyas Hariharan, Tristan Yver, Viktor Bunin, Will Price, and Zagabond Azuki on July 7, 2025. The CEO is Vaibhav Prakash. Kuru Labs is based in Bengaluru, India. Kuru Labs is a developer of a decentralized finance protocol designed to facilitate cryptocurrency trading for users. Website: www.kuru.io

Shtuchnyi raised $15.0 million at an unknown valuation from East-West Digital News Ventures on July 7, 2025. Shtuchnyi is based in Kyiv, Ukraine. Shtuchnyi is a developer of automated visual inspection systems designed to detect defects in industrial manufacturing.

Temelio raised $7.0 million at an $11.0 million valuation from Avenue Growth Partners on July 7, 2025. The CEO is Maya Kuppermann. Temelio is based in New York, NY. Temelio is a developer of a grants management platform designed to help foundations distribute, manage, and track the impact of their funds. Website: www.trytemelio.com

Castellum.AI raised $8.5 million at a $29.0 million valuation from Curql Collective, BTech Consortium, Cameron Ventures, Framework Venture Partners, Remarkable Ventures, and Spider Capital on July 8, 2025. The CEO is Peter Piatetsky. Castellum.AI is based in New York, NY. Castellum.AI is a developer of a compliance database platform designed to democratize financial crime compliance. Website: www.castellum.ai

Dextall raised $15.0 million at an $18.05 million valuation from Essence Development, L+M Development Partners, Simpson Strong-Tie Company, Lago Innovation Fund, and Y Capital Partners on July 8, 2025. The CEO is Aurimas Sabulis. Dextall is based in Fairfax, VA. Dextall is a manufacturer of proprietary, fully finished prefabricated exterior walls intended to accelerate decarbonization of the real estate and environment. Website: www.dextall.com

Ekho raised $15.0 million at a $17.3 million valuation from Activant Capital, Billy Blaustein, Jimmy Douglas, JP Morgan Chase, RiverPark Ventures, Severin Hacker, Steve Rayman, Westcott, Winnebago Industries, and Y Combinator on July 8, 2025. The CEO is Christopher Howard. Ekho is based in New York, NY. Ekho is a developer of an end-to-end vehicle commerce platform designed to streamline and modernize the way vehicles are sold online. Website: www.ekho.com

Gradient Labs raised $12.93 million at a $53.88 million valuation from Index Ventures, Redpoint Ventures, Exceptional Capital, Liquid 2 Ventures, Phoenix Court, Puzzle Ventures, and Tomorrow Tech on July 8, 2025. The CEO is Dimitri Masin. Gradient Labs is based in London, United Kingdom. Gradient Labs is a developer of an AI-based customer support platform intended to resolve complex customer service queries end-to-end. Website: www.gradient-labs.ai

Honor Education raised $38.0 million at a $45.0 million valuation from Alpha Edison, Audeo Ventures, Interlock Partners, New Wave Capital, and Wasserstein Debt Opportunities Management on July 8, 2025. The CEO is Joel Podolny. Honor Education is based in San Francisco, CA. Honor Education is a developer of a teaching and learning platform designed to provide access to a learning environment that fosters creative and critical thinking. Website: www.honor.education

Xpanceo raised $250.0 million at a $1,350.0 million valuation from Opportunity Ventures on July 8, 2025. The CEO is Roman Axelrod. Xpanceo is based in Dubai, United Arab Emirates. Xpanceo is a manufacturer of an AI-powered extended reality computing product intended for clients with smart contact lenses that fuse biotechnology and electronics. Website: www.xpanceo.com

Augmentus raised $11.0 million at a $24.45 million valuation from Woori Venture Partners, Cocoon Capital, EDBI, and Sierra Ventures on July 9, 2025. The CEO is Daryl Lim. Augmentus is based in Singapore, Singapore. Augmentus is a developer of no-code AI robotics software designed to offer robot vision and automated robot toolpath generation services. Website: www.augmentus.tech

GeodAlsics raised $5.81 million at a $6.22 million valuation from The Vidi Group on July 9, 2025. The CEO is Arnaud Attyé. GeodAlsics is based in Grenoble, France. GeodAlsics is a developer of a medtech company intended to offer AI-based clinical decision support modules. Website: geodaisics.com

NexBridge raised $8.0 million at an unknown valuation from Fulgur Ventures on July 9, 2025. The CEO is Nicolas Cane. NexBridge is based in San Salvador, El Salvador. NexBridge is an operator of a regulated digital asset issuance infrastructure designed to bring traditional financial assets on-chain with the security of Bitcoin. Website: www.nexbridge.io

aiOla raised $25.0 million at a $59.67 million valuation from United Airlines Ventures on July 10, 2025. The CEO is Amir Haramaty. aiOla is based in Herzliya, Israel. aiOla is a developer of a speech artificial intelligence technology designed to help enterprises and developers adopt speech technologies. Website: www.aiola.ai

SmartHome Solutions raised $5.0 million at an unknown valuation on July 10, 2025. The CEO is Jeff Binette. SmartHome Solutions is based in Kennebunk, ME. SmartHome Solutions is an operator of smart automation systems intended to simplify the management of home and commercial technologies. Website: smarthomesolutionsinc.com

Vellum raised $20.0 million at an unknown million valuation from Leaders Fund, Eastlink Capital, Pioneer Fund, Rebel Fund, Socii Capital, and Y Combinator on July 10, 2025. The CEO is Akash Sharma. Vellum is based in New York, NY. Vellum is a developer of an AI development platform designed to obtain optimal cost and quality for large language models. Website: www.vellum.ai

RealSense raised $50.0 million at an unknown valuation from Intel Capital and MediaTek Ventures on July 11, 2025. The CEO is Nadav Orbach. RealSense is based in Santa Clara, CA. RealSense is a developer of embedded vision hardware designed to enhance machine perception in robotics and biometric systems. Website: www.realsenseai.com

Claude’s view

The three most interesting deals to me are:

1. Xpanceo - $250 million at $1.35 billion valuation This is by far the largest Series A in the dataset and represents a fascinating convergence of biotech and consumer electronics. Smart contact lenses that provide augmented reality, health monitoring, and night vision capabilities could revolutionize how we interact with technology. The massive valuation suggests investors see this as potentially the next major computing platform after smartphones. The Dubai base also indicates significant Middle Eastern investment in frontier tech.

2. Kuru Labs - $11.6 million from Paradigm and 11 other crypto investors This deal stands out for having an unusually large investor syndicate (12 investors) for a relatively modest round, including top-tier crypto VCs like Paradigm and Electric Capital plus individual angel investors. The fully on-chain order book DEX represents a technically ambitious approach to decentralized trading that could solve real liquidity and user experience problems in DeFi. The Bangalore location also highlights India's growing crypto development ecosystem.

3. Honor Education - $38 million led by multiple institutional investors With Joel Podolny as CEO (former Dean of Apple University and Yale School of Management), this signals serious institutional backing for reimagining education technology. The focus on "creative and critical thinking" environments suggests they're tackling higher-order learning rather than basic skill acquisition. The $45 million post-money valuation with that leadership pedigree indicates potential for significant market disruption in the education sector.

These deals represent three major technology frontiers: human-computer interface evolution, decentralized finance infrastructure, and educational transformation.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.