Series A activity: Week of June 16, 2025

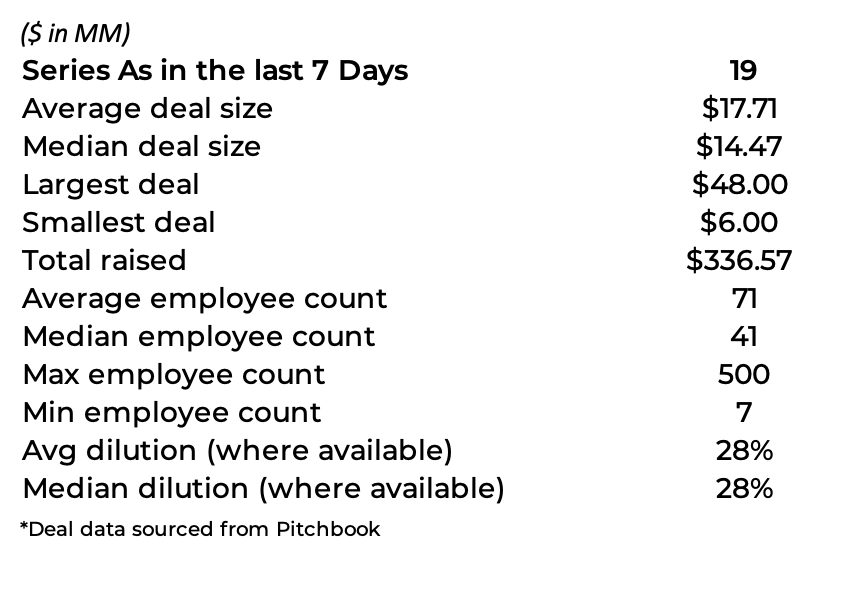

There were 19 Series As in the last week that raised a total of $337 million. The average deal size was $18 million while the median was $14 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude and GPT to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

Traversal raised $48.00 million at an unknown valuation from Kleiner Perkins, Hanabi Capital Management, Sequoia Capital, and others on June 18, 2025. The CEO is Anish Agarwal. Traversal is based in New York, NY. Traversal is a developer of an AI SRE agent platform intended to analyze logs, metrics, and traces to identify system issues. Website: www.traversal.com

HOPPR raised $31.50 million at an unknown valuation from Greycroft, Kivu Ventures, and others on June 17, 2025. The CEO is Khan Siddiqui. HOPPR is based in Chicago, IL. HOPPR is a developer of an artificial intelligence foundation model intended to empower developers to build medical imaging applications. Website: www.hoppr.ai

Jet HR raised $28.48 million at an unknown valuation from Base10 Partners on June 18, 2025. The CEO is Marco Ogliengo. Jet HR is based in Milan, Italy. Jet HR is a developer of a cloud-based platform designed to provide administrative management for small companies. Website: www.jethr.com

QuantWare raised $27.20 million at an unknown valuation from InnovationQuarter, Invest-NL, and others on June 17, 2025. The CEO is Matthijs Rijlaarsdam. QuantWare is based in Delft, Netherlands. QuantWare is a developer of scalable quantum processors intended to accelerate quantum computing usefulness. Website: www.quantware.com

Uncountable raised $27.00 million at an unknown valuation from Sageview Capital, 8VC, MK Capital, and others on June 17, 2025. The CEO is Noel Hollingsworth. Uncountable is based in San Francisco, CA. Uncountable is a developer of an AI-powered web platform designed to support and optimize scientific research work. Website: www.uncountable.com

Fiber Global raised $20.00 million at an unknown valuation from DBL Partners on June 17, 2025. The CEO is KC McCreery. Fiber Global is based in Lafayette, IN. Fiber Global is an operator of a climate technology company intended to focus on advancing building materials. Website: www.fiberglobal.com

Mercanis raised $20.00 million at an unknown valuation from AVP, Partech, and others on June 18, 2025. The CEO is Fabian Heinrich. Mercanis is based in Berlin, Germany. Mercanis is a developer of service buying platform designed to create a business environment. Website: www.mercanis.com

Multiplier Holdings raised $20.00 million at an unknown valuation from Lightspeed Venture Partners, EDBI, Ribbit Capital, and SV Angel on June 18, 2025. The CEO is Noah Pepper. Multiplier Holdings is based in Singapore, Singapore. Multiplier Holdings is an operator of a technology company intended to acquire and upgrade high-stakes service businesses. Website: www.multiplierholdings.com

Extend raised $17.00 million at an unknown valuation from Innovation Endeavors, Character, Homebrew, Y Combinator, and others on June 17, 2025. The CEO is Kushal Byatnal. Extend is based in New York, NY. Extend is an operator of internet extension tools intended to provide powered workflows inside existing tools. Website: www.extend.ai

Voliro raised $14.47 million at a $36.07 million valuation from Cherry Ventures and noa (London) on June 16, 2025. The CEO is Florian Gutzwiller. Voliro is based in Zurich, Switzerland. Voliro is a developer of robotic drones designed to perform contact-based work at height. Website: www.voliro.com

Oben Electric raised $11.67 million at an unknown valuation from Ambis Holdings, Helios Holdings, Karimjee Jivanjee, and others on June 18, 2025. The CEO is Madhumita Agarwal. Oben Electric is based in Bangalore, India. Oben Electric is an operator of a research and development-driven electric motorcycle company intended for emerging markets. Website: www.obenelectric.com

Peach Cars raised $11.00 million at an unknown valuation from Suzuki Global Ventures, Gogin Capital, and others on June 18, 2025. The CEO is Kaoru Kaganoi. Peach Cars is based in Nairobi, Kenya. Peach Cars is an operator of a used car marketplace platform intended to provide transparent buying and selling experiences. Website: peachcars.co.ke

Swarmia raised $11.00 million at an unknown valuation from Dig Ventures, Karma Ventures, and others on June 18, 2025. The CEO is Otto Hilska. Swarmia is based in Helsinki, Finland. Swarmia is a developer of business management software designed to build productive and engaged software teams. Website: www.swarmia.com

Reaction Dynamics raised $10.19 million at an unknown valuation on June 18, 2025. The CEO is Bachar Elzein. Reaction Dynamics is based in Saint-Jean-Sur-Richelieu, Canada. Reaction Dynamics is a developer of space transportation technologies designed to provide agile and affordable access to orbit. Website: www.reactiondynamics.space

Fiscal.ai raised $10.00 million at an unknown valuation from Portage, Social Leverage, and VanEck on June 20, 2025. The CEO is Braden Dennis. Fiscal.ai is based in Toronto, Canada. Fiscal.ai is a developer of an investment research platform designed for comprehensive financial analysis. Website: www.fiscal.ai

Acorn raised $9.06 million at a $59.58 million valuation from Level Equity on June 17, 2025. The CEO is Blake Proberts. Acorn is based in Canberra, Australia. Acorn is a developer of cloud-based human resource management software intended for solving common workplace problems. Website: www.acorn.works

PublicAI raised $8.00 million at an unknown valuation from Saudi Telecom Company and others on June 17, 2025. The CEO is Jordan Gray. PublicAI is based in San Francisco, CA. PublicAI is a developer of a multi-chain DAO platform intended to facilitate AI annotation work and data services. Website: www.publicai.io

Hydroblok raised $6.00 million at an unknown valuation from Andina Advisors and Pier 88 Investment Partners on June 17, 2025. The CEO is Colin House. Hydroblok is based in Hazelwood, MO. Hydroblok is a manufacturer of a modular shower system designed to simplify and expedite waterproof shower installations. Website: www.hydroblok.com

Veracity raised $6.00 million at an unknown valuation from Maveron and Melitas Ventures on June 17, 2025. The CEO is Alison Egan. Veracity is based in New York, NY. Veracity is a manufacturer of personal care and wellness products intended to offer knowledge on hormones and biofactors. Website: www.veracityselfcare.com

Claude’s view

The three most interesting deals to me are:

HOPPR ($31.5M) - They're building an AI foundation model specifically for medical imaging applications. This is fascinating because it's trying to democratize advanced medical AI tools that could make diagnostic imaging more accessible and efficient across healthcare systems. The potential impact on global healthcare delivery is enormous.

QuantWare ($27.2M) - A quantum processor company with a 3D chip architecture approach. What makes this compelling is they're not just building quantum computers, but focusing on scalable quantum processors that could actually solve real-world problems in climate and life sciences. The fact they're based in Delft (a major quantum research hub) adds credibility.

Traversal ($48M) - An AI SRE (Site Reliability Engineering) agent that can analyze logs, metrics, and traces to identify system issues. This addresses a massive pain point in modern software operations. As systems become more complex, having AI that can quickly diagnose problems and explain them in natural language could save companies millions in downtime costs.

All three are tackling complex technical problems with AI in sectors (healthcare, quantum computing, infrastructure ops) where breakthrough solutions could have massive industry impact. The funding amounts also suggest investors see significant potential in these approaches.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.