Series A activity: Week of June 2, 2025

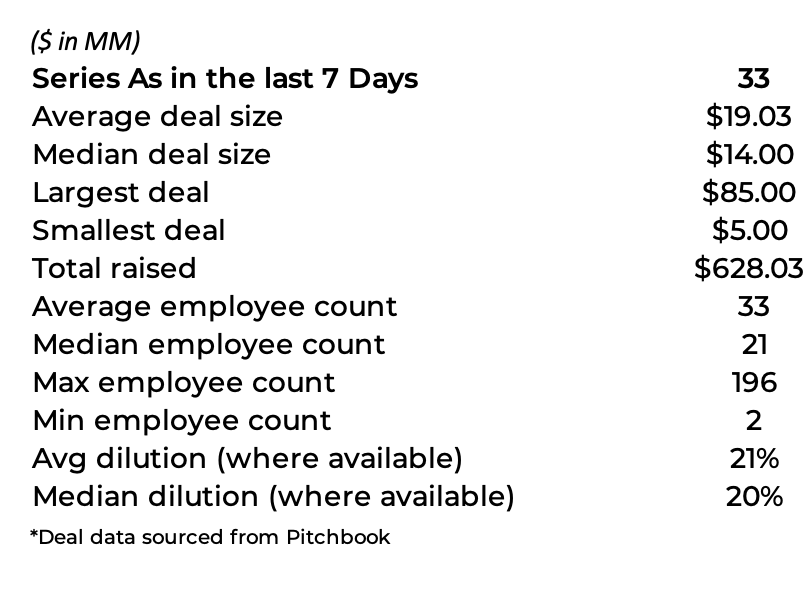

There were 33 Series As in the last week that raised a total of $628 million. The average deal size was $19 million while the median was $14 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude and GPT to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals.

All Series A Deals

Filmhub raised $6.98 million at a $59.50 million valuation from NextEquity Partners and RiverPark Ventures on June 2, 2025. The CEO is Alan d'Escragnolle. Filmhub is based in Sacramento, CA. Filmhub is a developer of a cloud-based digital film distribution platform designed to help filmmakers, producers, distributors and sales agents deliver and license titles to streaming channels. Website: www.filmhub.com

Netic raised $13.00 million at a $111.00 million valuation from Founders Fund on June 2, 2025. The CEO is Melisa Tokmak. Netic is based in San Francisco, CA. Netic is a developer of an AI-powered platform designed to autonomously manage and generate demand throughout the customer lifecycle. Website: www.netic.ai

Principia raised $49.35 million at an unknown valuation from Valor Capital Group on June 2, 2025. The CEO is Newton Alves. Principia is based in Sao paulo, Brazil. Principia is a developer of a financial platform designed to manage the economic processes of universities. Website: www.principia.net

Rally raised $11.00 million at a $52.00 million valuation from Canapi Ventures on June 2, 2025. The CEO is Oren Friedman. Rally is based in New York, NY. Rally is a developer of a customer relationship management platform designed to make it easy for teams to perform research practices. Website: www.rallyuxr.com

Lumber Manufactory raised $14.02 million at an unknown valuation from Ravelin Capital and Slow Ventures on June 2, 2025. The CEO is Michael Grasso. Lumber Manufactory is based in Washington, DC. Lumber Manufactory is an operator of a sawmill startup intended to revolutionize sustainable lumber production through modular, and adaptable sawmilling technology. Website: www.lumbermanufactory.com

Amplifye P24 raised $18.50 million at an unknown valuation from Magdalena on June 3, 2025. The CEO is John Melo. Amplifye P24 is based in Davis, CA. Amplifye P24 is a provider of a P24 enzyme intended to unlock the full benefits of protein by enhancing the absorption of critical nutrients. Website: www.amplifyeme.com

Avantis raised $8.00 million at an unknown valuation from Founders Fund and Pantera Capital on June 3, 2025. The CEO is Harsehaj Singh. Avantis is based in New York, NY. Avantis is a developer of a decentralized financial derivatives trading platform designed to build an ecosystem of margin-based products that are fully on-chain. Website: www.avantisfi.com

Handoff raised $5.70 million at a $87.65 million valuation from Masco Ventures on June 3, 2025. The CEO is Dmitry Alexin. Handoff is based in Brandon, FL. Handoff is a developer of a mobile and web app designed to provide remodeling contractors a fast, accurate, and intuitive way to create construction cost estimates. Website: www.handoff.ai

Labrys raised $20.00 million at an unknown valuation from Plural Platform on June 3, 2025. The CEO is August Lersten. Labrys is based in London, United Kingdom. Labrys is a developer of an enterprise management platform designed to streamline tasks such as onboarding, compliance, and payments. Website: www.labrys.tech

North American Energy Opportunities raised $6.23 million at an unknown valuation from Vienna Capital Partners on June 3, 2025. The CEO is Vincent deFilippo. North American Energy Opportunities is based in New York, NY. North American Energy Opportunities is a provider of capital market services intended for underserved United States and Canadian hydrocarbon producers. Website: www.northamericanenergyopportunities.com

Projectworks raised $12.00 million at an unknown valuation from Ten Coves Capital on June 3, 2025. The CEO is Mark Orttung. Projectworks is based in Wellington, New Zealand. Projectworks is a developer of a business management platform designed to track and record time spent on projects and manage project invoicing. Website: www.projectworks.com

ThreatSpike raised $14.00 million at an unknown valuation from Expedition Growth Capital on June 3, 2025. The CEO is Adam Blake. ThreatSpike is based in London, United Kingdom. ThreatSpike is a developer of a cybersecurity platform designed to provide continuous threat detection, response, and testing across enterprise environments. Website: www.threatspike.com

Trustifi raised $25.00 million at an unknown valuation from Camber Partners on June 3, 2025. The CEO is Rom Hendler. Trustifi is based in Las Vegas, NV. Trustifi is a developer of an email security platform designed to prevent attacks on the company's brand and intellectual property. Website: www.trustifi.com

Vegdog raised $10.15 million at an unknown valuation from ECBF Management on June 3, 2025. The CEO is Tessa Figlar. Vegdog is based in Munich, Germany. Vegdog is a producer of pet food intended to bring plant-based sustainability to pet food. Website: www.vegdog.de

Wordsmith raised $25.00 million at an unknown valuation from Index Ventures on June 3, 2025. The CEO is Ross McNairn. Wordsmith is based in London, United Kingdom. Wordsmith is a developer of a legal operations management platform designed to help teams interact across the business models. Website: www.wordsmith.ai

Baobab raised $13.54 million at an unknown valuation from eCapital and Viola FinTech on June 4, 2025. The CEO is Vincenz Klemm. Baobab is based in Berlin, Germany. Baobab is a provider of cyber-insurance services intended to offer compensation for expenses, fees, and legal costs arising due to cyber breaches. Website: www.baobab.io

Bioleum raised $85.00 million at an unknown valuation on June 4, 2025. The CEO is Kevin Kreisler. Bioleum is based in Oklahoma City, OK. Bioleum is an operator of a renewable fuel company intended to focus on producing and utilizing lignocellulosic biomass-derived fuels. Website: www.bioleum.com

Compyl raised $12.00 million at an unknown valuation from Venture Guides on June 4, 2025. The CEO is Stas Bojoukha. Compyl is based in New York, NY. Compyl is a developer of an information security and automation platform designed to offer a scalable governance, risk, and compliance ecosystem. Website: www.compyl.com

Emptyvessel raised $6.25 million at an unknown valuation from 1AM Gaming and NCSoft on June 4, 2025. The CEO is Emanuel Palalic. Emptyvessel is based in Austin, TX. Emptyvessel is a developer of a video game creation studio designed to empower creators. Website: www.emptyvessel.io

Jua raised $11.01 million at a $48.02 million valuation from Ananda Impact Ventures and Future Energy Ventures on June 4, 2025. The CEO is Marvin Gabler. Jua is based in Zürich, Switzerland. Jua is a developer of an artificial intelligence-based forecasting platform designed for weather prediction and environmental analysis. Website: www.jua.ai

Metaforms raised $9.34 million at a $32.00 million valuation on June 4, 2025. The CEO is Akshat Tyagi. Metaforms is based in Bangalore, India. Metaforms is a developer of language artificial intelligence tools designed to turn the forms into AI conversations. Website: www.metaforms.ai

MIND raised $30.00 million at an unknown valuation from Crosspoint Capital Partners and Paladin Capital Group on June 4, 2025. The CEO is Eran Barak. MIND is based in Seattle, WA. MIND is a developer of an AI-enabled data security platform intended to protect an organization's sensitive information. Website: www.mind.io

Obvio raised $22.00 million at an unknown valuation from Bain Capital Ventures on June 4, 2025. The CEO is Dhruv Maheshwari. Obvio is based in San Carlos, CA. Obvio is a developer of solar-powered AI cameras designed to detect driving violations. Website: www.obvio.ai

Sema4.ai raised $25.00 million at a $505.00 million valuation from Benchmark Email, Cox Enterprises, Mayfield Fund, MVP Ventures, Rocketship.vc, and Snowflake Ventures on June 4, 2025. The CEO is Rob Bearden. Sema4.ai is based in Atlanta, GA. Sema4.ai is a developer of enterprise artificial intelligence agents designed to automate complex tasks requiring reasoning, collaboration, and judgment. Website: www.sema4.ai

VersiFi raised $20.82 million at an unknown valuation from Hunting Hill Global Capital on June 4, 2025. The CEO is Sameer Shalaby. VersiFi is based in New York, NY. VersiFi is a developer of a digital asset management platform intended to maximize the potential of digital investments. Website: www.versifi.io

Aive raised $13.54 million at an unknown valuation from The Invus Group on June 5, 2025. The CEO is Olivier Reynaud. Aive is based in Paris, France. Aive is a developer of an artificial intelligence-based platform designed for the post-production of audio-visual content. Website: www.aive.com

Crabi raised $20.60 million at a $50.60 million valuation from Kaszek on June 5, 2025. The CEO is Daniel Bernardez. Crabi is based in Mexico City, Mexico. Crabi is a developer of an automobile insurance platform designed to offer a new way of insurance that focuses on the person and not the car. Website: www.crabi.com

Impart Security raised $12.00 million at a $62.01 million valuation from Madrona Venture Group on June 5, 2025. The CEO is Jonathan DiVincenzo. Impart Security is based in Coral Gables, FL. Impart Security is a developer of an application programming interface (API) security collaboration platform designed to eliminate last-minute security patches. Website: www.impart.security

Thread AI raised $20.00 million at an unknown valuation from Greycroft on June 5, 2025. The CEO is Angela McNeal. Thread AI is based in New York, NY. Thread AI is a developer of a composable artificial intelligence orchestration platform designed to bridge the gap between AI potential and secure, reliable adoption and implementation. Website: www.threadai.com

AirCapture raised $50.00 million at an unknown valuation from Larsen Lam Climate Change Foundation on June 6, 2025. The CEO is Matthew Atwood. AirCapture is based in Berkeley, CA. AirCapture is a developer of direct air capture technology designed to create a circular commercial carbon economy. Website: www.aircapture.com

Infisical raised $16.00 million at an unknown valuation from Elad Gil on June 6, 2025. The CEO is Vlad Matsiiako. Infisical is based in San Francisco, CA. Infisical is a developer of an open-source platform designed to securely sync secrets and configures across the team, devices, and infrastructure. Website: www.infisical.com

SCATR raised $5.00 million at a $23.64 million valuation on June 6, 2025. The CEO is Matthew Carpenter. SCATR is based in Cleveland, OH. SCATR is a developer of a zero-trust security platform designed to secure and obfuscate communications between endpoints that are transmitting data packets across trusted, untrusted, and compromised networks. Website: www.scatr.it

Toma raised $17.00 million at an unknown valuation from Andreessen Horowitz on June 6, 2025. The CEO is Monik Pamecha. Toma is based in San Francisco, CA. Toma is a developer of a personalized artificial intelligence agent platform designed to manage customer interactions and automate routine processes for dealerships. Website: www.toma.com

Claude’s (Sonnet 4) thoughts on the most interesting deal of the week

“Based on this week's deals, Sema4.ai stands out as the most compelling investment story and the most likely candidate to raise a Series B within 12 months. The Atlanta-based company raised $25 million at a $505 million post-money valuation - a premium pricing that signals strong investor confidence and rapid growth trajectory. Their focus on enterprise AI agents that automate complex business tasks requiring reasoning and judgment positions them perfectly at the intersection of two massive trends: enterprise AI adoption and workflow automation. With backing from notable investors including Cox Enterprises, Mayfield Fund, and Snowflake Ventures, they have both the capital and strategic partnerships to scale rapidly. The enterprise AI market is exploding, and companies that can demonstrate clear ROI through task automation are seeing explosive growth. Given their high valuation and the competitive landscape in enterprise AI, Sema4.ai will likely need significant additional capital within the next year to maintain their market position and continue R&D investments. Long-term, this could be the biggest winner of the cohort - if they can establish themselves as the go-to platform for enterprise AI agents, they're looking at a potential multi-billion dollar outcome in a market that's still in its early innings.”

- Claude Sonnet 4

GPT’s (o3) thoughts on the most interesting deal of the week

Most interesting deal right now

—

Netic

Round: $13 M on a $111 M post-money

Crazy stat: just 2 employees → $55 M valuation per employee

Investors: Founders Fund, Elad Gil, Alexandr Wang, Dylan Field, Greylock, SV Angel, etc.

What it does: AI “autopilot” that books jobs, engages leads, and runs demand gen for plumbing / HVAC / electrical contractors.

Why it’s fascinating: A blue-collar services market that runs on pen-and-paper is getting a Salesforce-style platform backed by A-tier angels. If Netic’s tech really drives revenue for thousands of small contractors, the upside is enormous—and the sky-high valuation signals something non-obvious is working.

Most likely to raise a Series B within 12 months

—

Wordsmith

Round: $25 M on a ~$30 M post-money

Headcount: 28

Investors: Index Ventures (lead), Kinnevik

What it does: Legal-ops workflow SaaS that lets business teams self-serve contract reviews, triage, knowledge search, etc.

Why a quick Series B is likely:

Large $25 M check at a low valuation—investors are buying speed, not dilution sensitivity.

Enterprise legal budgets already exist; ACVs can scale fast.

Index Ventures has a playbook for blitz-scaling horizontal SaaS.

If Wordsmith hits ~$5-8 M ARR this year, a $40-60 M Series B by mid-2026 is the obvious next step.

Will be the biggest long-term company —

Sema4.ai

Round: $25 M on a $480 M pre-money (i.e., already Series-B-sized economics)

Headcount: 58

Investors: Mayfield, Snowflake Ventures, Cox Enterprises, Rocketship, Benchmark Email, MVP Ventures

What it does: Enterprise-grade AI agents that run directly on AWS/Snowflake, orchestrating complex, multi-step workflows over customer data.

Why it can dwarf the rest:

Half-billion valuation at Series A ⇒ investors see a multi-billion-dollar TAM.

Snowflake as a strategic backer gives built-in distribution to thousands of data-warehouse customers.

If AI agents become as ubiquitous as APIs, the layer that provisions, governs, and monitors those agents is a potential “platform of record,” worth tens of billions.

TL;DR

Netic is the wild, high-reward bet worth watching.

Wordsmith has the metrics and backers to land a Series B within a year.

Sema4.ai is already capitalized like a future platform giant—and could end up the largest company on the list.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.