Series A activity: Week of June 30, 2025

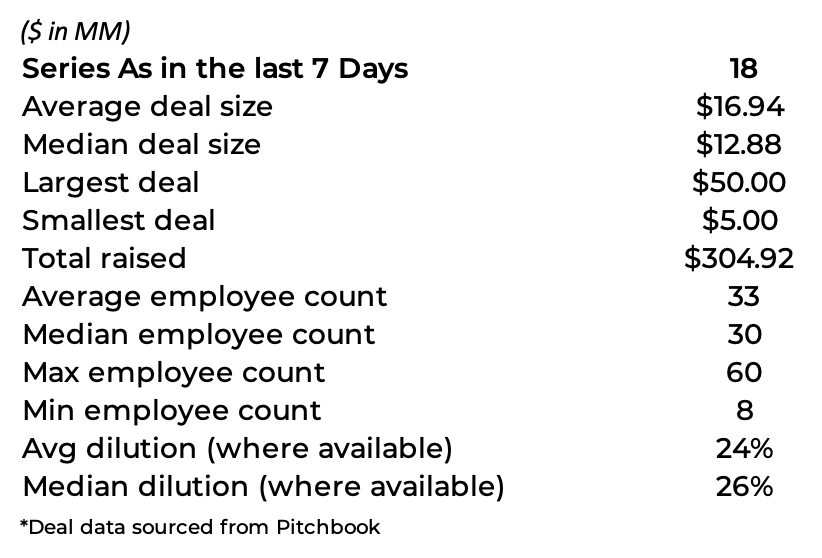

There were 18 Series As in the last week that raised a total of $305 million. The average deal size was $17 million while the median was $13 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

Tandem Health raised $50 million at an unknown valuation from Kinnevik on June 30, 2025. The CEO is Lukas Saari. Tandem Health is based in Stockholm, Sweden. Tandem Health is a developer of an AI-based healthcare data platform designed for clinics to revolutionize healthcare workflows and delivery. Website: www.tandemhealth.ai

Campfire raised $35 million at a $122 million valuation from Accel on June 30, 2025. The CEO is John Glasgow. Campfire is based in San Francisco, CA. Campfire is a developer of revenue management software designed to automate revenue recognition and reporting for accounting and finance teams. Website: www.campfire.ai

Flō Optics raised $35 million at an unknown valuation from MEI Systems and SDC Technologies on July 2, 2025. The CEO is Jonathan Jaglom. Flō Optics is based in Petach Tikva, Israel. Flō Optics is a developer of an ophthalmic coating platform designed for smart coatings of eyeglasses. Website: www.flo-optics.com

The Open Platform raised $28.50 million at an unknown valuation from Ribbit Capital on July 3, 2025. The CEO is Andrew Rogozov. The Open Platform is based in Abu Dhabi, United Arab Emirates. The Open Platform is a developer of blockchain infrastructure designed to facilitate decentralized applications and crypto transactions within the Telegram ecosystem. Website: www.top.co

Ambrook raised $26.10 million at an unknown valuation from Field Ventures and Thrive Capital on July 1, 2025. The CEO is Mackenzie Burnett. Ambrook is based in Denver, CO. Ambrook is a developer of a financial management platform designed to help family-run American businesses become more profitable and resilient. Website: www.ambrook.com

Remark raised $16 million at an unknown valuation from Inspired Capital on July 1, 2025. The CEO is Theo Satloff. Remark is based in New York, NY. Remark is an operator of a shopping guidance platform intended to bring quality interactions of in-store specialty retail into the online ecosystem for businesses. Website: www.withremark.com

Chloris Geospatial raised $14.76 million at a $43.76 million valuation from At One Ventures, AXA Investment Managers, Cisco Foundation, Counteract Partners, NextEnergy Sustainable Technology for the Planet, and Orbia Ventures on June 30, 2025. The CEO is Marco Albani. Chloris Geospatial is based in Boston, MA. Chloris Geospatial is a developer of remote sensing technology designed to monitor natural resources. Website: www.chloris.earth

NuCicer raised $13.76 million at an unknown valuation from Better Ventures, Kale United, Leaps by Bayer, and Stray Dog Capital on June 30, 2025. The CEO is Kathryn Cook. NuCicer is based in Davis, CA. NuCicer is a producer of nutritious chickpeas intended to meet the demand for protein intake for the global population. Website: www.nucicer.com

AssetCool raised $13.57 million at an unknown valuation from Energy Impact Partners on July 2, 2025. The CEO is Niall Coogan. AssetCool is based in Leeds, United Kingdom. AssetCool is a developer of photonic coatings and materials designed to optimize the performance of electricity networks. Website: www.assetcool.com

Senseye raised $12.18 million at an unknown valuation from 4D Capital, Capital Factory, Hack VC, What If Ventures, and XB Ventures on July 3, 2025. The CEO is David Zakariaie. Senseye is based in Austin, TX. Senseye is a developer of a diagnostic platform intended to empower people to take charge of their mental health. Website: www.senseye.co

AI Hay raised $10 million at an unknown valuation from Argor on July 1, 2025. The CEO is Duc Tran. AI Hay is based in Ho Chi Minh City, Vietnam. AI Hay is a developer of an artificial intelligence answer engine intended to enable users to access information through a question-and-answer format. Website: www.ai-hay.vn

MediShout raised $9 million at an unknown valuation from Heal Capital on July 1, 2025. The CEO is Ashish Kalraiya. MediShout is based in London, United Kingdom. MediShout is a developer of a cloud-based healthcare technology platform designed to solve problems that arise due to inefficiencies in the hospital environment. Website: www.medishout.co.uk

Liki24 raised $9 million at an unknown valuation from Anton Borzov, Dnipro, ICLUB, MA7 Ventures, N1, SID Venture Partners, TA Ventures, and u.ventures on July 3, 2025. The CEO is Anton Avrinsky. Liki24 is based in Kyiv, Ukraine. Liki24 is an operator of an e-commerce pharmacy platform intended to provide a wide selection of medicines and make healthcare accessible. Website: www.liki24.com

Azra AI raised $7.95 million at a $194 million valuation on July 3, 2025. The CEO is John Marshall. Azra AI is based in Nashville, TN. Azra AI is a developer of an artificial intelligence workflow automation platform designed to identify and triage oncology patients who need treatment and follow-up care. Website: www.azra-ai.com

Qedma raised $7.43 million at an unknown valuation from Glilot Capital Partners on July 3, 2025. The CEO is Asif Sinay. Qedma is based in Tel Aviv, Israel. Qedma is a developer of quantum software designed to solve critical problems to reach a state where the computers can be used to solve application problems. Website: www.qedma.com

Vok raised $6 million at an unknown valuation from SQM Lithium Ventures on July 2, 2025. The CEO is Indrek Petjärv. Vok is based in Tallinn, Estonia. Vok is a manufacturer of electric cargo bikes intended to solve transportation hassles for couriers and postal workers. Website: www.vokbikes.com

American AI Logistics raised $5.67 million at a $24 million valuation from Companyon Ventures on July 3, 2025. The CEO is John Cofrancesco. American AI Logistics is based in Orlando, FL. American AI Logistics is a developer of AI-driven proposal creation software intended to automate the bidding process for government contracts. Website: americanailogistics.com

North raised $5 million at an unknown valuation from Companyon Ventures on June 30, 2025. The CEO is Matthew Biringer. North is based in New York, NY. North is a developer of a cloud automation platform designed for simple AWS optimization with AI. Website: www.north.cloud

Claude’s view

The three most interesting deals to me are:

1. The Open Platform ($28.5M) - Telegram Ecosystem Play

This is fascinating because it's building blockchain infrastructure specifically within Telegram's ecosystem. With Telegram having 900+ million users, this represents a massive potential user base for decentralized applications. The timing is particularly interesting as Telegram has been increasingly crypto-friendly, and this could be positioning for when mainstream social platforms fully embrace Web3 functionality. The backing from Ribbit Capital (known for fintech expertise) and Pantera Capital (crypto specialists) shows strong institutional confidence in the Telegram-crypto convergence thesis.

2. Azra AI ($7.95M at $194M valuation) - High Pre-Money

This deal stands out for its extremely high valuation relative to funding amount - a $194M post-money on just an $8M raise suggests a pre-money valuation of ~$186M. For a healthcare AI company focused on oncology workflow automation, this indicates either: (a) significant existing revenue/traction, (b) extremely strong IP/technology moat, or (c) a very hot market for cancer detection AI. The fact they didn't disclose investors suggests this might be an insider round or strategic corporate investment, which could explain the premium valuation.

3. Tandem Health ($50M) - European Healthcare AI at Scale

As the largest deal of the week, this Swedish company represents the growing strength of European AI healthcare startups. With Kinnevik leading (a major Swedish investment company), this shows European VCs are willing to write large checks for homegrown AI talent. The focus on clinical workflow automation addresses a massive pain point - administrative burden is one of the biggest causes of physician burnout. The $50M size suggests they're planning rapid expansion across European healthcare systems, potentially positioning for a major exit to a healthcare incumbent.

Each deal represents a different macro trend: crypto-social convergence, AI-powered healthcare efficiency, and the premium valuations in specialized AI markets.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.