Series A activity: Week of June 9, 2025

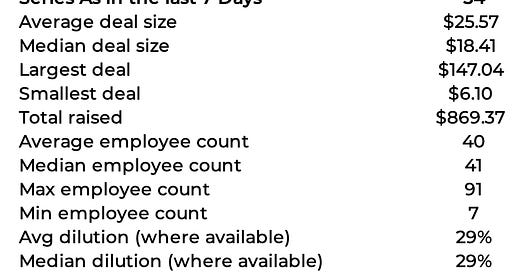

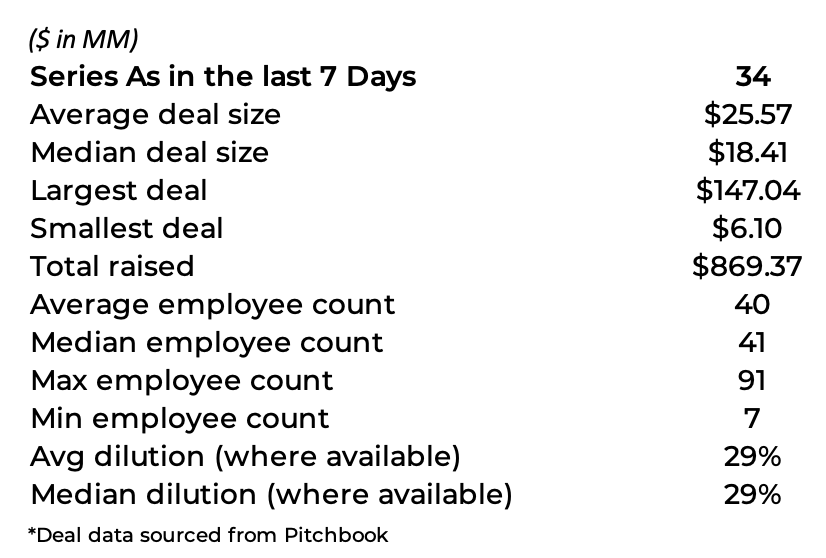

There were 34 Series As in the last week that raised a total of $869 million. The average deal size was $26 million while the median was $18 million.

Summary Stats

Data for Series A deals done worldwide (ex-China) where amount raised is greater than $5M and the company is not focused on therapeutics

I’ve started asking Claude and GPT to use the weekly data to figure out which are the most interesting companies each week. We’re going to watch these picks over the next year and see how they perform.

Those responses are below the full list of this week’s deals. Claude seems to like robots, and the power systems necessary for more AI.

All Series A Deals

Proxima Fusion raised $161.74 million at an unknown valuation from Balderton Capital, Cherry Ventures, Redalpine, Bayern Kapital, Club degli investitori, DeepTech & Climate Fonds, Elaia Partners, High-Tech Gründerfonds, Investor Club, Leitmotif, Lightspeed Venture Partners, Omnes Capital, Plural Platform, UVC Partners, Visionaries Tomorrow, and Wilbe Capital on June 10, 2025. The CEO is Francesco Sciortino. Proxima Fusion is based in Munich, Germany. Proxima Fusion is a developer of fusion power plants designed to produce emissions-free power. Website: www.proximafusion.com

AIM raised $91.07 million at a $200.00 million valuation from Catalyze Advisors, DCVC, General Catalyst, Human Capital, Ironspring Ventures, Khosla Ventures, Liquid 2 Ventures, Mantis VC, MVP Ventures, Oliver Cameron, Page One Ventures, and Qasar Younis on June 10, 2025. The CEO is Adam Sadilek. AIM is based in Monroe, WA. AIM is a manufacturer of autonomous machines intended to upshift the civilization's capabilities. Website: www.aim.vision

Logos raised $50.00 million at an unknown valuation from US Innovative Technology Fund on June 12, 2025. The CEO is Milo Medin. Logos is based in Redwood City, CA. Logos is an operator of a satellite-based communications company intended for space technology and broadband networks sectors. Website: www.logosspace.com

Ellipsis Health raised $45.00 million at an unknown valuation from CVS Health Ventures, Khosla Ventures, Salesforce, AME Cloud Ventures, Colliers International, E12 Venture Capital, and Mitsui Global Investment on June 12, 2025. The CEO is Mainul Mondal. Ellipsis Health is based in San Francisco, CA. Ellipsis Health is a developer of an artificial intelligence-powered care management technology designed to automate and enhance clinical operations in healthcare settings. Website: www.ellipsishealth.com

LookUp raised $43.63 million at an unknown valuation from ETF Partners, European Innovation Council, Expansion Ventures, Karista, KFund, and MIG AG on June 12, 2025. The CEO is Michel Friedling. LookUp is based in Toulouse, France. LookUp is a developer of a comprehensive space safety platform designed to detect, track, and protect against orbital threats, ensuring sustainable space operations. Website: www.lookupspace.com

Payrails raised $32.00 million at an unknown valuation from HV Capital, Northzone Ventures, Andreessen Horowitz, Cherry Ventures, EQT Ventures, General Catalyst, and Speedinvest on June 12, 2025. The CEO is Orkhan Abdullayev. Payrails is based in Berlin, Germany. Payrails is a developer of a cloud-native payment operating system designed to simplify accepting payments. Website: www.payrails.com

Autonomize raised $28.65 million at an unknown valuation from Cigna Ventures, Tau Ventures, Valtruis, Asset Management Ventures, ATX Venture Partners, and Capital Factory on June 12, 2025. The CEO is Ganesh Padmanabhan. Autonomize is based in Austin, TX. Autonomize is a developer of an artificial intelligence copilot intended to reduce the administrative burden for healthcare knowledge workers to make data-driven decisions. Website: www.autonomize.ai

Nooks raised $25.00 million at an unknown valuation from Zigg Capital, Lockheed Martin Ventures, SAIC Capital, and Upper90 Capital Management on June 9, 2025. The CEO is Sean Blackman. Nooks is based in Arlington, VA. Nooks is a developer of a flexible access infrastructure platform designed for secure work environments. Website: www.nooks.works

Maze raised $25.00 million at an unknown valuation from Theory Ventures, Cherry Ventures, and Tapestry VC on June 10, 2025. The CEO is Harry Wetherald. Maze is based in London, United Kingdom. Maze is a developer of a security platform designed to use modern AI to make decisions, instead of pre-defined logic. Website: www.mazehq.com

Turnstile raised $22.81 million at a $76.81 million valuation on June 9, 2025. The CEO is Michael Babineau. Turnstile is based in San Francisco, CA. Turnstile is a developer of a revenue automation platform designed to simplify complex quote-to-cash workflows and meet pricing and operational needs without compromising efficiency. Website: www.tryturnstile.com

Shinkei raised $22.00 million at an unknown valuation from Founders Fund, Interlagos Capital, CIV, Global Brain, JAWS Estates Capital, Mantis VC, Shrug Capital, and Yamato Holdings on June 13, 2025. The CEO is Saif Khawaja. Shinkei is based in El Segundo, CA. Shinkei is a developer of a commercial fish processing technology designed to minimize fish waste and multiply shelf-life. Website: www.shinkei.systems

Ballers raised $20.00 million at an unknown valuation from RHC Group, Sharp Alpha Advisors, Andre Agassi, Connor Garnett, David Blitzer, Kim Clijsters, Maarten Paes, and Sloane Stephens on June 9, 2025. The CEO is David Gutstadt. Ballers is based in Philadelphia, PA. Ballers is an operator of a chain of health and fitness clubs based in Philadelphia, Pennsylvania. Website: www.ballers-philly.com

OneBalance raised $20.00 million at an unknown valuation from Blockchain Capital, Cyber.Fund, L2IV, and Mirana Ventures on June 11, 2025. The CEO is Stephane Gosselin. OneBalance is based in London, United Kingdom. OneBalance is a developer of an account framework designed to address the fragmented user experience in the Web3 ecosystem. Website: www.onebalance.io

Zorro raised $20.00 million at an unknown valuation from Entrée Capital, 10D, and Pitango Venture Capital on June 11, 2025. The CEO is Guy Ezekiel. Zorro is based in New York, NY. Zorro is a developer of a healthcare financial companion designed to improve access to healthcare by making coverage more affordable. Website: www.myzorro.co

Antimetal raised $20.00 million at an unknown valuation from Sound Ventures, Aaron Levie, Arash Ferdowsi, Aravind Srinivas, Ben Uretsky, Buckley Ventures, Daniel Gross, Nat Friedman, and Naval Srinivasan on June 13, 2025. The CEO is Matthew Parkhurst. Antimetal is based in New York, NY. Antimetal is a developer of an automated cloud cost optimization platform designed for financial efficiency. Website: www.antimetal.com

Polimorphic raised $18.64 million at a $70.64 million valuation on June 9, 2025. The CEO is Parth Shah. Polimorphic is based in New York, NY. Polimorphic is a developer of constituent relationship management software designed for local governments to manage interactions with constituents. Website: www.polimorphic.com

Arketa raised $18.18 million at an unknown valuation from Inspired Capital, Amity Ventures, First Round Capital, Recall Capital, Velvet Sea Ventures, and Y Combinator on June 9, 2025. The CEO is Rachel Lea Fishman. Arketa is based in New York, NY. Arketa is a developer of a wellness platform designed to help fitness instructors grow their online businesses. Website: www.arketa.com

Posterity Health raised $17.04 million at a $62.00 million valuation from Georgetown Equity Partners, Boston Millennia Partners, Distributed Ventures, FCA Venture Partners, Scrub Capital, SteelSky Ventures, and WVV Capital on June 12, 2025. The CEO is Pamela Pure. Posterity Health is based in Centennial, CO. Posterity Health is an operator of a digital male fertility platform intended to learn about fertility and take action. Website: www.posterityhealth.com

Outset.ai raised $17.00 million at an unknown valuation from 8VC, Adverb Ventures, Alt Capital, Bain & Company, Genius Ventures, Rebel Fund, Ritual Capital, and Y Combinator on June 11, 2025. The CEO is Aaron Cannon. Outset.ai is based in San Francisco, CA. Outset.ai is an operator of artificial intelligence-interview tools intended to conduct and analyze qualitative research. Website: www.outset.ai

ConductorAI raised $15.00 million at an unknown valuation from Lux Capital, Abstract Ventures, Also Capital, Alt Capital, Booz Allen Ventures, Forward Deployed VC, Haystack Management Company, Humba Ventures, and Sunflower Capital on June 10, 2025. The CEO is Zachary Long. ConductorAI is based in Biddeford, ME. ConductorAI is a developer of an artificial intelligence compliance platform designed to attribute work to relevant policies and procedures. Website: www.conductorai.co

Remarcable raised $15.00 million at a $122.00 million valuation from Insight Partners on June 10, 2025. The CEO is Clint Zhang. Remarcable is based in Highland Heights, OH. Remarcable is a developer of a cloud platform designed to help purchase and manage all materials and tools in a single place. Website: www.remarcable.com

Tractor Zoom raised $15.00 million at a $60.00 million valuation on June 12, 2025. The CEO is Kyle McMahon. Tractor Zoom is based in West Des Moines, IA. Tractor Zoom is an operator of an online agricultural marketplace intended to connect farmers with equipment auctioneers digitally. Website: www.tractorzoom.com

GovWorx raised $13.90 million at a $53.50 million valuation from Serent Capital on June 10, 2025. The CEO is Scott MacDonald. GovWorx is based in Denver, CO. GovWorx is a developer of an AI-based technology platform designed to assist law enforcement, 911 emergency communications centers and fire/EMS agencies. Website: www.govworx.ai

Q5D raised $13.50 million at an unknown valuation from Chrysalix Venture Capital, Lockheed Martin Ventures, Maven Capital Partners, Centre for Process Innovation, EverQuest Capital Partners, HAX, Innovate UK, Reinforced Ventures, SOSV, UK Innovation & Science Seed Fund, and UntroD on June 10, 2025. The CEO is Stephen Bennington. Q5D is based in Portishead, United Kingdom. Q5D is a developer of a laser micromachining technology designed to automate the intricate process of electric component connection. Website: www.q5d.com

FlyGuys raised $13.21 million at an unknown valuation on June 13, 2025. The CEO is Joseph Stough. FlyGuys is based in Lafayette, LA. FlyGuys is a provider of drone services intended to make aerial data accessible and affordable. Website: www.flyguys.com

VODA.ai raised $12.36 million at a $43.00 million valuation from CRH Ventures, Ferguson Ventures, and L-Stone Capital on June 10, 2025. The CEO is Georgios Demosthenous. VODA.ai is based in Boston, MA. VODA.ai is a developer of water utility-based artificial intelligence software designed to conduct virtual condition assessments for water pipe asset management and wastewater utilities. Website: www.voda.ai

Eli Health raised $12.00 million at an unknown valuation from Business Development Bank of Canada, Accelia Capital, Foreground Capital, Garage Capital, IKJ Capital, Leva Capital, Muse Capital, NextBlue, Real Ventures, Rocana Ventures Partners, Swizzle Ventures, and TELUS Global Ventures on June 10, 2025. The CEO is Marina Rivas. Eli Health is based in Montreal, Canada. Eli Health is a developer of a hormone monitoring kit designed for real-time health insights. Website: eli.health

Kolet raised $11.14 million at an unknown valuation from Daphni, Jon Gieselman, and Peter Kern on June 10, 2025. The CEO is Eduardo Ronzano. Kolet is based in Paris, France. Kolet is a developer and distributor of embedded SIM cards designed to facilitate global connectivity for all. Website: www.kolet.com

Try Your Best raised $11.00 million at an unknown valuation from Offline Ventures, Strobe Ventures, Castle Island Ventures, Coinbase Ventures, Crossbeam Venture Partners, and Unusual Ventures on June 11, 2025. The CEO is Tyler Haney. Try Your Best is based in Tucson, AZ. Try Your Best is a developer of an online play-to-earn portal intended to influence the brands and get rewarded. Website: www.tyb.xyz

Better Trucks raised $10.78 million at an unknown valuation on June 10, 2025. The CEO is Andrew Whiting. Better Trucks is based in Hillside, IL. Better Trucks is a provider of package delivery services intended to serve online retail companies. Website: www.bettertrucks.com

Taiv raised $10.50 million at an unknown valuation from IDC Ventures, Aperiam Ventures, EMERGING, FJ Labs, Gaingels, Garage Capital, Mu Ventures, Pioneer Fund, Unpopular Ventures, and Y Combinator on June 9, 2025. The CEO is Noah Palansky. Taiv is based in Winnipeg, Canada. Taiv is an operator of a television advertising firm intended to show special and upcoming events during commercial breaks. Website: www.taiv.tv

Altura raised $9.94 million at an unknown valuation from Octopus Ventures, Curiosity VC, Fortino Capital Partners, Pawel Smoczyk, and Perry Oostdam on June 9, 2025. The CEO is Matthijs Huiskamp. Altura is based in Amsterdam, Netherlands. Altura is a developer of bid management software designed for optimizing proposal creation and collaboration. Website: www.altura.io

TomBot raised $6.10 million at a $30.10 million valuation from Caduceus Capital Partners and Wavemaker Three-Sixty Health on June 12, 2025. The CEO is Thomas Stevens. TomBot is based in Santa Clarita, CA. TomBot is a developer of personal care robots designed to provide animal therapy for dementia sufferers and help them overcome loneliness and depression. Website: www.tombot.com

Sanlayan Technologies raised $0.26 million at an unknown valuation from Ashish Kacholia, Jungle Ventures, Lashit Sanghvi, Gemba Capital, Shastra VC, and Singularity Ventures on June 9, 2025. The CEO is Rohan Gala. Sanlayan Technologies is based in Bengaluru, India. Sanlayan Technologies is a manufacturer of mission-critical electronics systems intended to advance indigenous product development in aerospace and defense. Website: www.sanlayan.com

Claude’s favorites:

Looking at the data, I'd say these three deals stand out as the most interesting:

1. Proxima Fusion ($161.74M) - The fusion breakthrough This is fascinating because fusion power has been the "holy grail" of clean energy for decades. The massive round size ($161.74M) and the stellar investor lineup (including Lightspeed, Balderton, Cherry Ventures) suggests serious institutional confidence that we're finally approaching commercially viable fusion. The fact they're using "quasi-isodynamic stellarators" - a specific advanced fusion reactor design - indicates this isn't just hype but real technical progress.

2. AIM ($91.07M) - Autonomous everything What makes this compelling is the scope of their vision: "upshift civilization's capabilities" by retrofitting any heavy equipment into autonomous machines. The $200M valuation and backing from top-tier VCs (Khosla, General Catalyst, DCVC) suggests they've cracked something fundamental about autonomy that goes beyond just self-driving cars. The ability to retrofit existing equipment rather than requiring all-new machines could be a massive market unlock.

3. Shinkei ($22.00M) - AI meets ancient industry This one's interesting because it's applying cutting-edge AI to one of humanity's oldest industries - fishing. The promise to "minimize fish waste and multiply shelf-life" addresses both sustainability and food security. Founders Fund's backing (they're known for contrarian, high-impact bets) plus the Japanese investor Yamato Holdings suggests this could transform global food supply chains in ways we haven't seen before.

Each represents a different type of breakthrough: energy transformation, automation revolution, and sustainable food systems.

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.