We’ve seen across the board that the mega venture firms ($1B+ per fund) typically break down their funds into dedicated vehicles for different investing strategies–for example, seed, early, and growth funds. As venture markets have matured rapidly over the last ten years, the top firms have been aggressively raising bigger funds to meet the demands of the market.

Overall, this has given funds more flexibility to give companies more capital, even at the earliest stages. For example, we’ve seen the emergence of the $100M Series A, for very early bets. And at the same time, venture firms are more eager than ever to compete against traditional growth funds at the later stages, all the way up to IPO.

The firms we have covered to date–Accel, a16z, Lightspeed, General Catalyst, and Index Ventures–all invest from seed to late stage. Although the majority of their capital is reserved for late stage investments, they still compete aggressively at the Seed and Series A because entry price and ownership matter.

Khosla Ventures is a prime example of a fund who is known for taking founder and technology bets at the early stages. For example, quietly investing $50M in OpenAI back in 2019. Most firms break out their investment team by stage focus, but Khosla has a single investing team investing across 3 funds–seed, early, and growth.

Find our Khosla Ventures Tear Sheet 👉 here.

Source 👉 https://docs.google.com/spreadsheets/d/1ZJY23w-4d2uGQiXbIvMNgdvx3NcJs4Mok3cVxxpO99A/edit?gid=358009475#gid=358009475

$3.5 Billion for Seed, Early, and Growth

Khosla is reportedly raising $3.5B in new funds. They last raised $3B in 2023 (source).

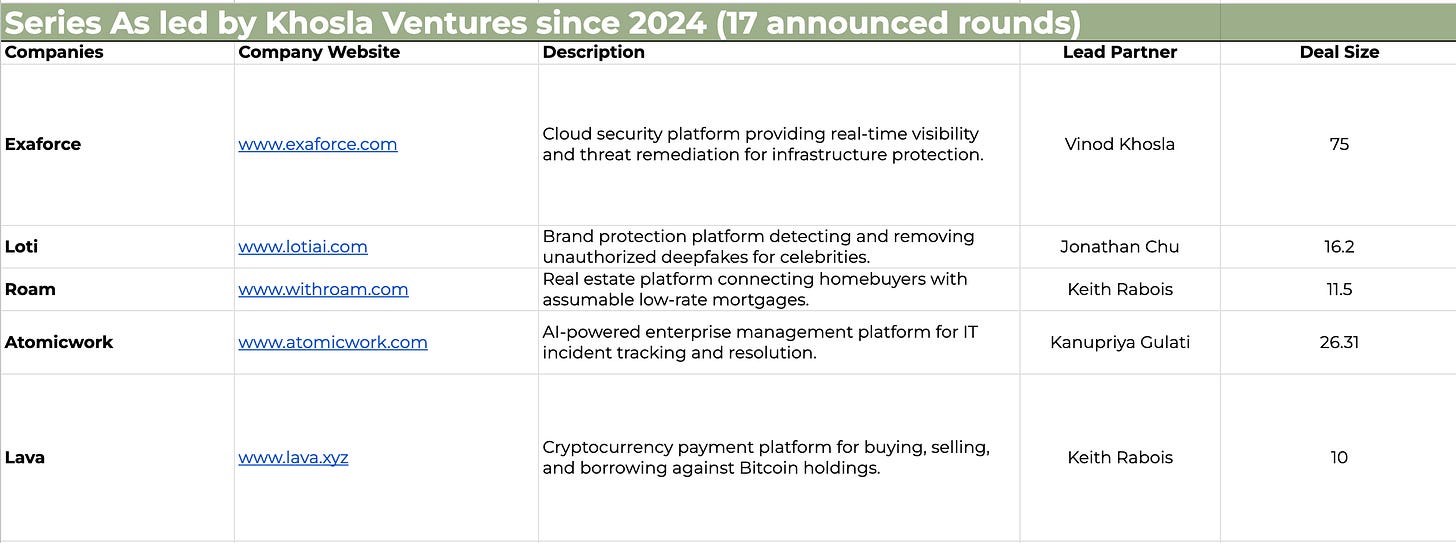

17 Series As led by Khosla Ventures

Khosla led 17 Series As since 2024. The largest round was Sakana AI’s $214M round, co-led with NEA and Lux. The firm led 14 rounds in the US and 3 in Asia.

7 Partners led Series As

Khosla has 5 managing directors, as well as partners, principals, and associates.

Named lead partners on announced Series As since 2024: Vinod Khosla (4), Keith Rabois (4), Jon Chu (3), Kanupriya Gulati (1), David Weiden (1), Sven Strohband (1), Alexander Morgan (1).

___

Disclosures

This material is intended for information purposes only and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Unless otherwise stated, all views or opinions herein are solely those of the author(s), and thus any view, comments, or outlook expressed in this communication may differ substantially from any similar material issued by other persons or entities. The information contained in this communication is based on generally available information and although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured and such information may be incomplete or condensed. The information in this communication does not constitute tax, financial, or legal advice.